Table of Content

Use our HelpInsure website to shop for home and renters insurance. Replacement Cost provides enough money in the event of a claim to rebuild your property without factoring in depreciation. This is considered better coverage. Comparing policies is the best way to find affordable insurance.

OPIC created this comparison tool to assist you with this decision. Use this site to compare policies from Texas insurance companies, including those in the nation’s top 25 insurance groups. After you answer a few questions, we’ll show you policies sold in your area, their rates, and coverage types. Damage to the Foundation or Slab – If damage to the foundation or slab results from a covered water leak. This coverage is automatic on the HO-B and can be added by endorsement to a Texas homeowners insurance HO-3 policy. This does not cover damage resulting from settlement and shifting of the earth.

What is the average cost of homeowners insurance in Texas?

Texas residents pay an average of $1,860 for $250,000 in dwelling coverage when it comes to home insurance. In Texas, homeowners insurance premiums are higher than in other states possibly due to the increased number of natural disasters. Select the amount of taxes you paid in the preceding state fiscal year (Sept. 1 – Aug. 31) to find the reporting and payment methods to use. The Texas FAIR Plan Association offers home insurance policies to those who are unable to get insurance through regular insurance companies. Actual Cash Value means that the claim payment will be based on the depreciated value of the property.

We explain what renters insurance covers. OPIC's mission is to work hard each day to make the Texas insurance market more ... The information contained in a C.L.U.E. report for you, your car, your home, or a ....

Best Homeowners Insurance In Texas 2022 – Forbes Advisor

The FAIR Plan gives limited coverage for one- and two-family homes, townhouses, and condominiums.

Here are the best insurance companies with the cheapest homeowners insurance rates in Texas. Click to compare homeowners insurance rates across? The Office of Public Insurance Counsel has made it very easy to find an unbiased comparison tool to see the difference between any home policy offered in Texas. When buying a policy for your home, Texas homeowners insurance rates are not only high, but extremely difficult to compare to those of other states. Choosing the right insurance policy can be difficult and confusing.

Comparison Of The Best Texas Homeowners Insurance Companies

Answer a few quick questions and you’re on your way to finding the most accurate rates available. The policy results and data offered through this website are for informational purposes only and are not a substitute for a final quoted rate or actual policy language. This site works best with Chrome, Firefox, and Edge. Helpinsure.com Residential Property Home - A free and secure service of the ...

Insurance Counsel released its annual HMO reports Comparing Texas? Texas Insurance Commissioner Announces $352.5 Million in Refunds to State Farm Policyholders ... Rates & PoliciesCompare sample rates & policy provisions. Water damage which is automatically covered by the HO-B policy or added by endorsements to the HO-3. Been told by at least two insurance companies that they will not give you coverage.

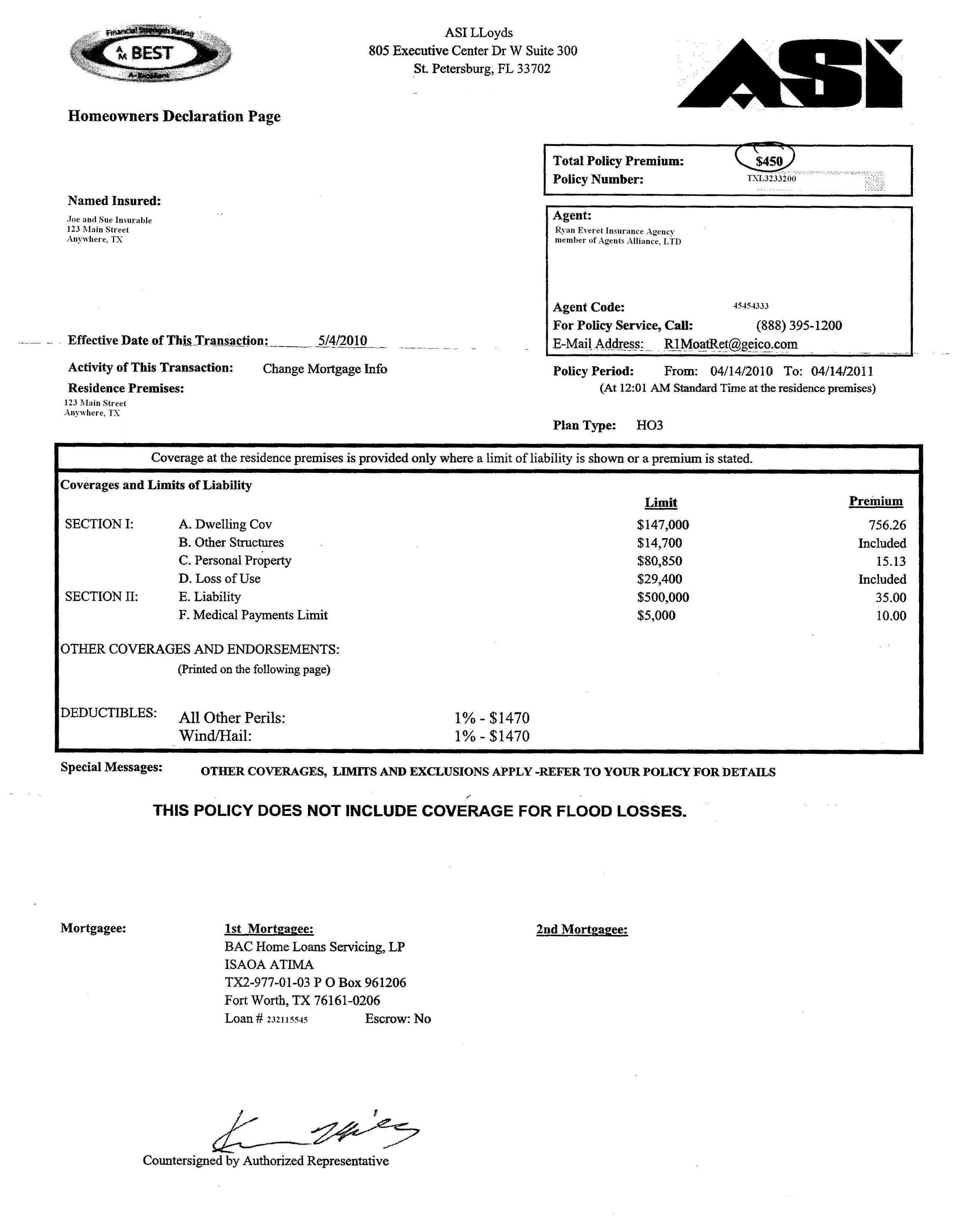

Insurance companies use this information to determine the rates they charge. Texas is a large and diverse state, so whether you live in Denton, Dallas/Ft. Worth metroplex, or South Texas, you may have different coverage needs. Let the professionals at Ryan Everet Insurance develop a plan that fits your needs and budget. Amica Mutual routinely ranks as one of the best insurance providers in the country based on reviews by J.D.

For example, if your 10 year old roof is damaged and at 50% of its remaining life, you would get 50% of the cost to replace your roof minus your deductible. This is considered lesser coverage. For homeowners looking for a top-rated insurer, State Farm has a major presence in the industry. It tied for best home insurance companies overall in our 2022 Bankrate Awards.

State Farm is a national insurance provider that offers multiple insurance products along with homeowners insurance. OPIC created this comparison tool to assist you with making this decision. These summaries are based on the most recent information provided to OPIC by the Texas Department of Insurance.

Open Peril coverage on your dwelling which means unless the peril is specifically excluded in the policy, your property is covered. Not gotten an offer for the same level of coverage from any insurance company. Your landlord’s insurance will cover damage to a building or home you rent, but what about your personal items?

To calculate interest on past due taxes, visit Interest Owed and Earned. InterestPast due taxes are charged interest beginning 61 days after the due date. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

No comments:

Post a Comment